The Social Model of Disability

Traditional Models of Disability

The Social Model of Disability was developed by disabled people to identify and take action against disabled people’s oppression and exclusion. It was developed as a direct challenge to the prevailing models of disability. These often viewed disability as an individual, medical problem that needed to be prevented, cured or contained, or as a charitable issue that viewed disabled people as needing to be pitied and catered for by segregated, charitable services.

The Social Model of Disability

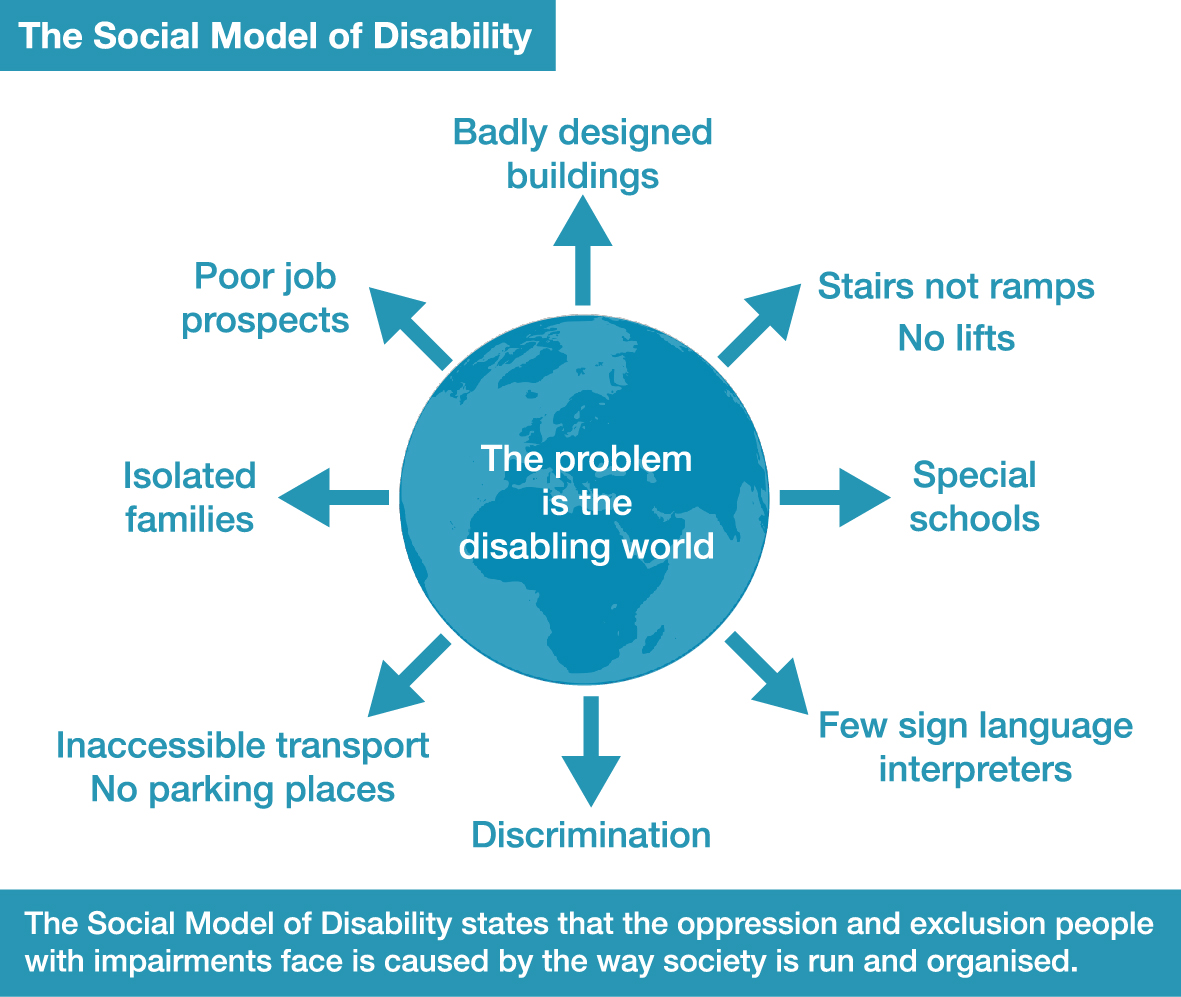

The Social Model of Disability, developed over the last 40 years by disabled people, is a radically different model to the medical and charitable approach to disability described above. It states that people have impairments but that the oppression, exclusion and discrimination people with impairments face is not an inevitable consequence of having an impairment, but is caused instead by the way society is run and organised.

The Social Model of Disability holds that people with impairments are ‘disabled’ by the barriers operating in society that exclude and discriminate against them.

The Social Model not only identifies society as the cause of disability but, equally importantly, it provides a way of explaining how society goes about disabling people with impairments. Sometimes referred to as a “barriers-approach”, the Social Model provides a “route map” that identifies both the barriers that disable people with impairments and how these barriers can be removed or minimised by other forms of support.

Next steps

Take a look at the resources available below for additional reading about the Social Model of Disability.